Our roots lie in building and operating real businesses. This operational DNA shapes how we evaluate companies, partner with management teams, and create long-term value across cycles.

Bringing worldwide dynamics together to form clear, focused understanding.We seek to construct a well-diversified portfolio that integrates both traditional and alternative asset classes, with the objective of delivering strong risk-adjusted returns throughout the investment horizon.

Our investment approach combines established market research frameworks with data-driven decision-making, guided by four core investment principles. This integration ensures a balanced synergy between time-tested fundamentals and advanced analytical insights.

These principles encompass global economic analysis from micro to macro perspectives, systematic risk management, dynamic trade structuring, and efficient resource allocation.

Our leadership is guided by discipline and dependability, creating a culture grounded in accountability, resilience, and collaboration. We emphasize prudent, well-evaluated decision-making that supports strategic alignment and teamwork. Through a balance of adaptability and deep expertise, we effectively navigate complex market landscapes while maintaining consistency in execution. Our dedication to ethical standards and transparency fosters lasting trust with stakeholders and reinforces our standing as an organization of integrity.

We harness our extensive financial knowledge and industry experience to deliver tailored solutions that drive tangible results. Our team of experts is dedicated to understanding your unique needs and challenges.

Discover how strategic planning and smart financial decisions can help you achieve long-term financial success. Learn key insights and tools to grow, manage, and protect your wealth effectively.

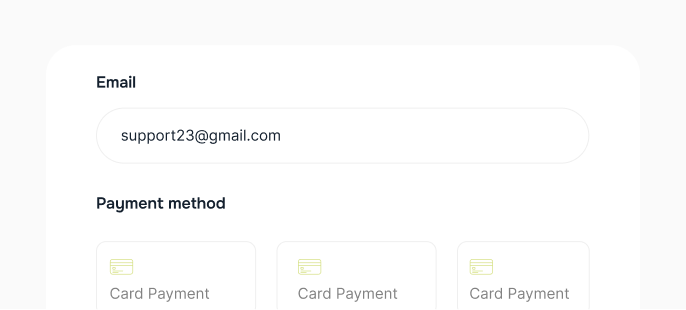

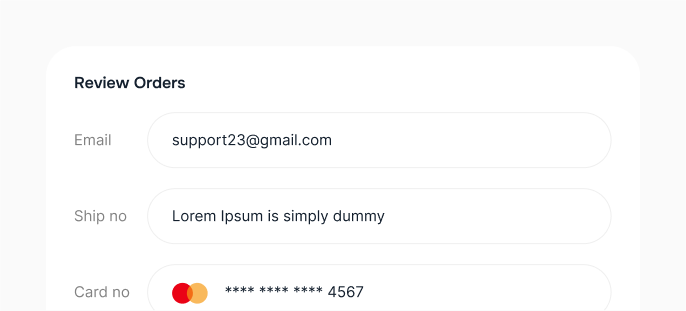

Learn how our proven financial process guides you step-by-step toward achieving your financial goals. From personalized planning to strategic execution.

Our team comprises seasoned professionals with extensive.

Improve cash flow structured savings budgeting techniques

Stay on track with your financial goals through regular check-ins

Explore fun and surprising facts about the financial world. Learn how history, trends, and innovations have shaped today’s finance landscape, making it easier to navigate your financial journey.

To create a business budget, start by estimating your income and listing all fixed and variable expenses. Subtract expenses from income.

Cash flow refers to the movement of money in and out of your business. Positive cash flow ensures you can cover operational costs.

Build financial stability by maintaining a strong cash reserve, cutting unnecessary costs, managing debt carefully.

Key financial metrics include net profit margin, cash flow, operating expenses, debt-to-equity ratio, and return on investment (ROI).

You should review your budget monthly or quarterly to ensure you're on track with projections. Regular reviews help.

FinTech solutions can streamline financial operations through automation, improve data accuracy, enhance decision-making.

"The team provided exceptional financial guidance tailored to my needs. Their expert advice helped me grow my investments while ensuring financial security for the future. I highly recommend their services for anyone seeking trusted, personalized financial solutions!"

"The team provided exceptional financial guidance tailored to my needs. Their expert advice helped me grow my investments while ensuring financial security for the future. I highly recommend their services for anyone seeking trusted, personalized financial solutions!"

DuneVista Capital is a multi-jurisdiction asset management group investing across private equity, public markets, hedge funds, and commodities.